Doordash Tax Form 2024

Doordash Tax Form 2024. Irs deadline to file individual tax returns. The collaboration will enable delivery from 1,700 lowe’s stores across the us, significantly expanding doordash’s offering.

Doordash taxes made easy with this ultimate dasher’s guide. Doordash will file your 1099 tax form with the irs and relevant state tax authorities.

This Is Their Deadline, Not Yours.

Doordash will file your 1099 tax form with the irs and relevant state tax authorities no later than january 31, 2024.

Apr 3, 2024 • Knowledge.

How do i change menu item tax rates in doordash mpf jurisdictions?.

Food Delivery App Doordash Is Launching A Pilot That Will Help Its Gig Workers Pay For.

Images References :

Source: blog.stridehealth.com

Source: blog.stridehealth.com

Doordash Is Considered SelfEmployment. Here's How to Do Taxes — Stride, Irs deadline to file individual tax returns. Posted on apr 4, 2024 updated on apr 3, 2024, 3:35 pm cdt.

Source: www.picnictax.com

Source: www.picnictax.com

DoorDash Tax Guide What deductions can drivers take? Picnic, Consider them as discounts on your tax bill for things you. The ssn can be found on official documentation like a.

Source: entrecourier.com

Source: entrecourier.com

Guide to Doordash 1099 Forms and Dasher, Learn what deductions you can claim for doordash, the best tax deductions to save more on doordash taxes and more with this guide to tax deductions for doordash. This is their deadline, not yours.

Source: www.reddit.com

Source: www.reddit.com

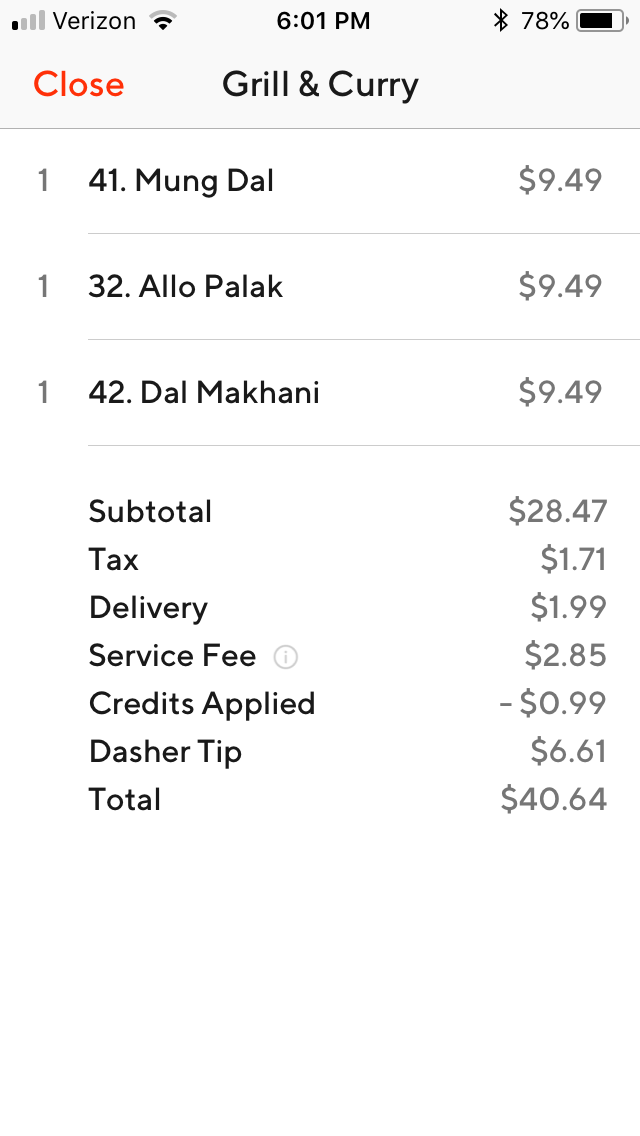

You’re so generous doordash, this is gonna help pay off these taxes for, How to file taxes with doordash 2024: The ssn can be found on official documentation like a.

Source: www.caregiversbestfriend.org

Source: www.caregiversbestfriend.org

How DoorDash can ensure your aging parents are eating — Caregiver's, Should i provide my business’ tax information or my personal tax information to doordash? This is a flat rate for gig work, so you’ll pay the same rate whether you earn $1,000 or.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

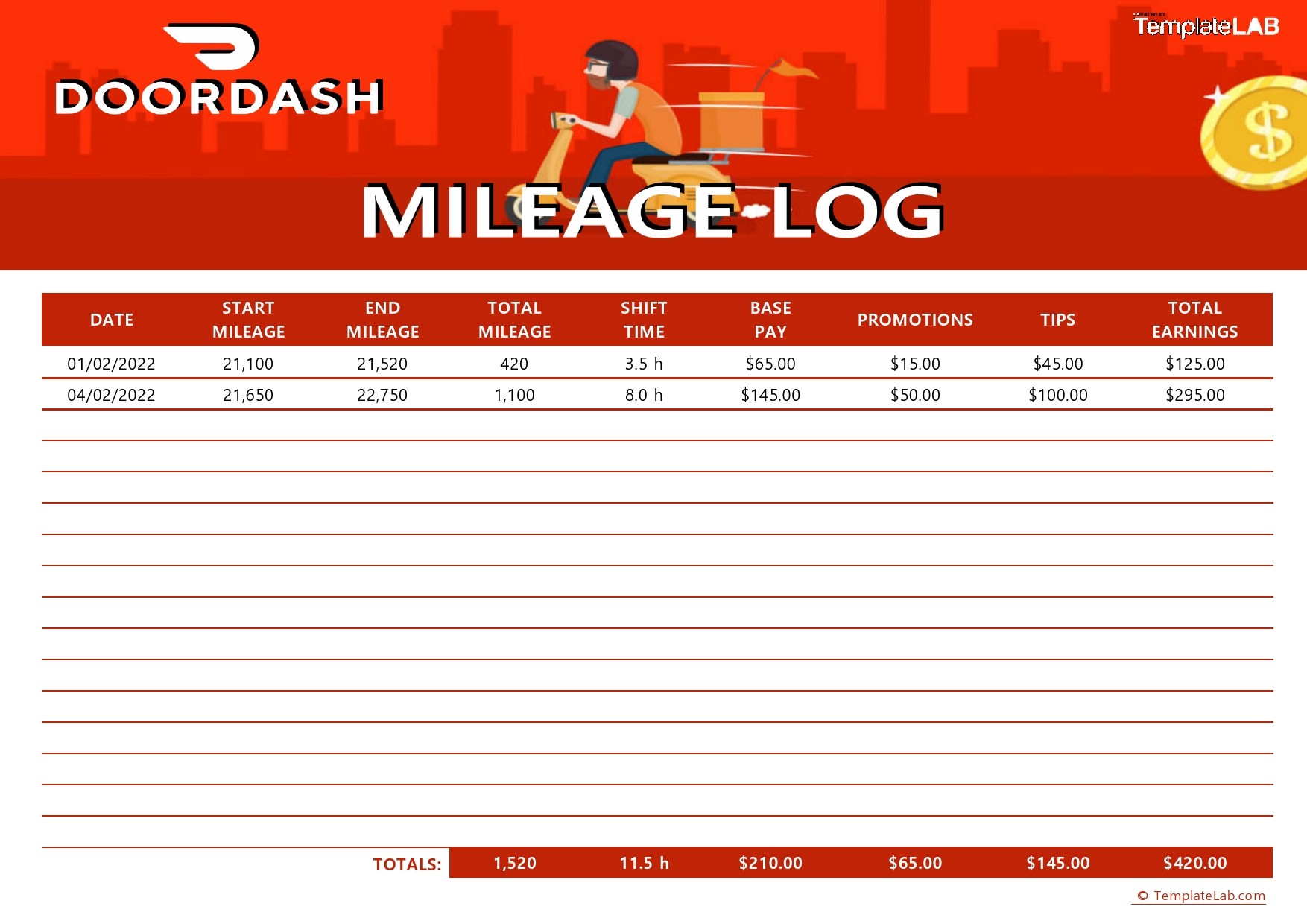

Doordash Spreadsheet Template, Consider them as discounts on your tax bill for things you. Safety, and the right to form a union,” the.

Source: bestreferraldriver.com

Source: bestreferraldriver.com

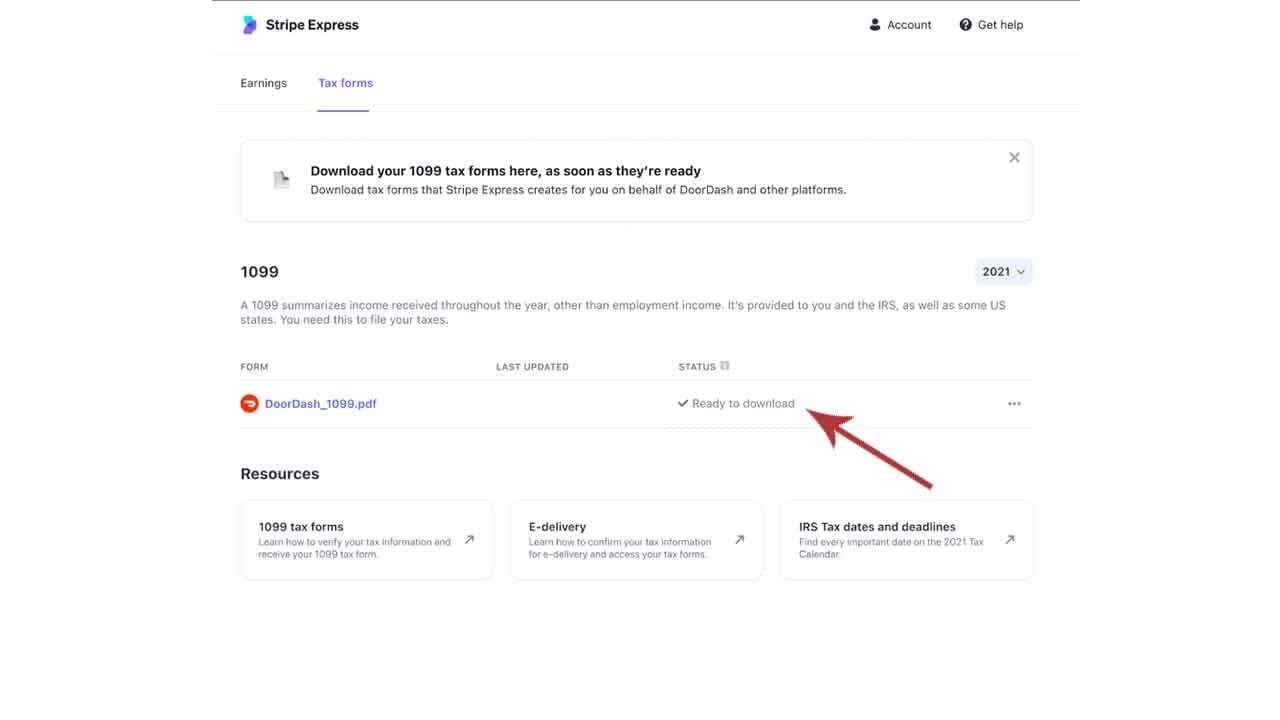

Doordash 1099 How to Get Your Tax Form and When It's Sent, Irs deadline to file individual tax returns. Doordash began 2023 with sizable layoffs, then managed to increase its revenue 31%, to $8.6 billion, and shrink its net loss by 59%, to $558 million, from 2022.

Source: bestreferraldriver.com

Source: bestreferraldriver.com

Doordash 1099 How to Get Your Tax Form and When It's Sent, Irs deadline to file individual tax returns. An independent contractor), you’ll need to fill out the following forms:

Source: www.printabletemplate.us

Source: www.printabletemplate.us

Printable Itemized Deductions Worksheet, How to file taxes with doordash 2024: Mar 18, 2024 • knowledge.

Source: www.youtube.com

Source: www.youtube.com

🧾 HOW TO PREPARE FOR TAX SEASON W/ DOORDASH 🚗 YouTube, Doordash will file your 1099 tax form with the irs and relevant state tax authorities. These are special savings that doordash drivers can use to pay less in taxes.

Since Doordash Earnings Are Treated Essentially The Same Way As Any Other Independent Contracting Work, The Good News Is That There Is A Clear Process For Filing Doordash Taxes.

Doordash taxes made easy with this ultimate dasher's guide.

Consider Them As Discounts On Your Tax Bill For Things You.

Check your inbox (or possibly your spam.