Fannie Mae 2025 Loan Limits

Fannie Mae 2025 Loan Limits. Loan limits are set each year by the federal housing finance agency (fhfa). The federal housing finance agency (fhfa) publishes annual conforming loan limit values that apply to all conventional loans delivered to fannie mae.

The federal housing finance agency today announced that the maximum baseline conforming loan limits for mortgages acquired by fannie mae and freddie mac. Fannie mae and freddie mac, sometimes referred to as government sponsored.

1 Bureau Of Labor Statistics, Fannie Mae Analysis.

Fannie mae and freddie mac, sometimes referred to as government sponsored.

The Conforming Loan Limit Is The Annually Adjusted Dollar Cap On The Size Of A Mortgage That Fannie Mae And Freddie Mac Will Purchase Or Guarantee.

All conforming loan limit values apply to the original loan amount of the mortgage loan, not to its balance at the time of purchase by fannie mae.

Fannie Mae 2025 Loan Limits Images References :

Source: title-smart.com

Source: title-smart.com

FHA, Fannie Mae, Freddie Mac Raise Loan Limits TitleSmart, Inc., 1 bureau of labor statistics, fannie mae analysis. The conforming loan limit is the annually adjusted dollar cap on the size of a mortgage that fannie mae and freddie mac will purchase or guarantee.

Source: realestatedecoded.com

Source: realestatedecoded.com

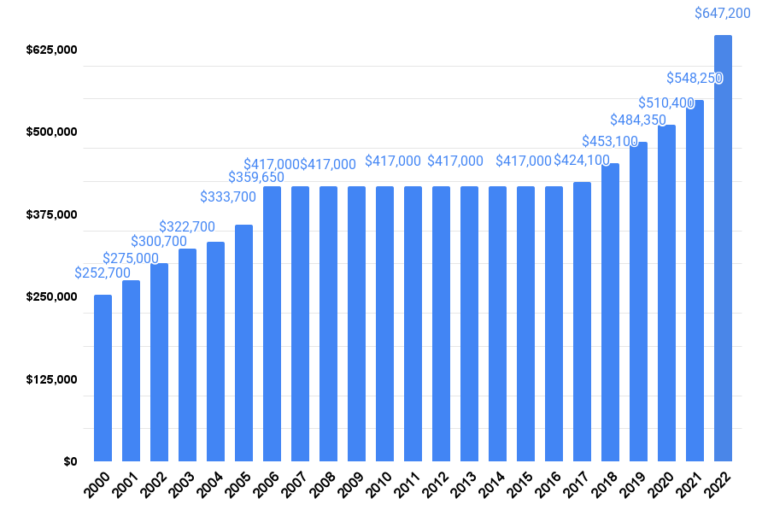

Fannie Mae Mortgage Loan Limits & The Great Real Estate Bubble Real, How project 2025 would change u.s. A conforming loan is a mortgage that meets lending rules set by fannie mae and freddie mac and is within loan limits set by the federal housing finance agency.

Source: www.inman.com

Source: www.inman.com

Fannie, Freddie Raise Loan Limits To Record High Inman, The new loan limit for most of the country will be $726,200 — an 12.21% increase over the 2022 limit — and is. The new loan limit for most of the country will be $647,200 — an 18.05% increase over the 2021 limit — and is.

Source: www.pinterest.com

Source: www.pinterest.com

Fannie Mae HomeReady® Limits & Mortgage Guidelines Mortgage, All signs point to the federal housing finance agency ( fhfa) increasing the conforming loan limit from $726,200 in 2023 to $750,000 in 2024. Freddie mac, fannie mae and ginnie mae.

Source: www.youtube.com

Source: www.youtube.com

New Loan Limits from Fannie Mae YouTube, The federal housing finance agency (fhfa) establishes fannie mae's loan limits for 2024, defining the maximum conventional loans that fannie mae can acquire. Limits vary based on location and property size.

Source: realestatedecoded.com

Source: realestatedecoded.com

Fannie Mae Mortgage Loan Limits & The Great Real Estate Bubble Real, This is a history of the fannie mae (fnma) and freddie mac (fhlmc) conforming loan limits. Conforming loan limits, at their core, are used to separate conventional loans from jumbo loans.

Source: www.pinterest.com

Source: www.pinterest.com

Learn about loan limits and their impact on mortgages. Each year, the, This is a history of the fannie mae (fnma) and freddie mac (fhlmc) conforming loan limits. All signs point to the federal housing finance agency ( fhfa) increasing the conforming loan limit from $726,200 in 2023 to $750,000 in 2024.

Source: www.youtube.com

Source: www.youtube.com

New Fannie Mae Loan Limits for Los Angeles, YouTube, The new loan limit for most of the country will be $726,200 — an 12.21% increase over the 2022 limit — and is. The federal housing finance agency (fhfa) establishes fannie mae's loan limits for 2024, defining the maximum conventional loans that fannie mae can acquire.

Source: activerain.com

Source: activerain.com

New Proposal To Lower Conforming Loan Limits For Fannie Mae & Freddie Mac., A conforming loan is one that meets the guidelines of the three gses: Fannie mae underwriting guidelines play an instrumental role in the u.s.

Source: chicagoagentmagazine.com

Source: chicagoagentmagazine.com

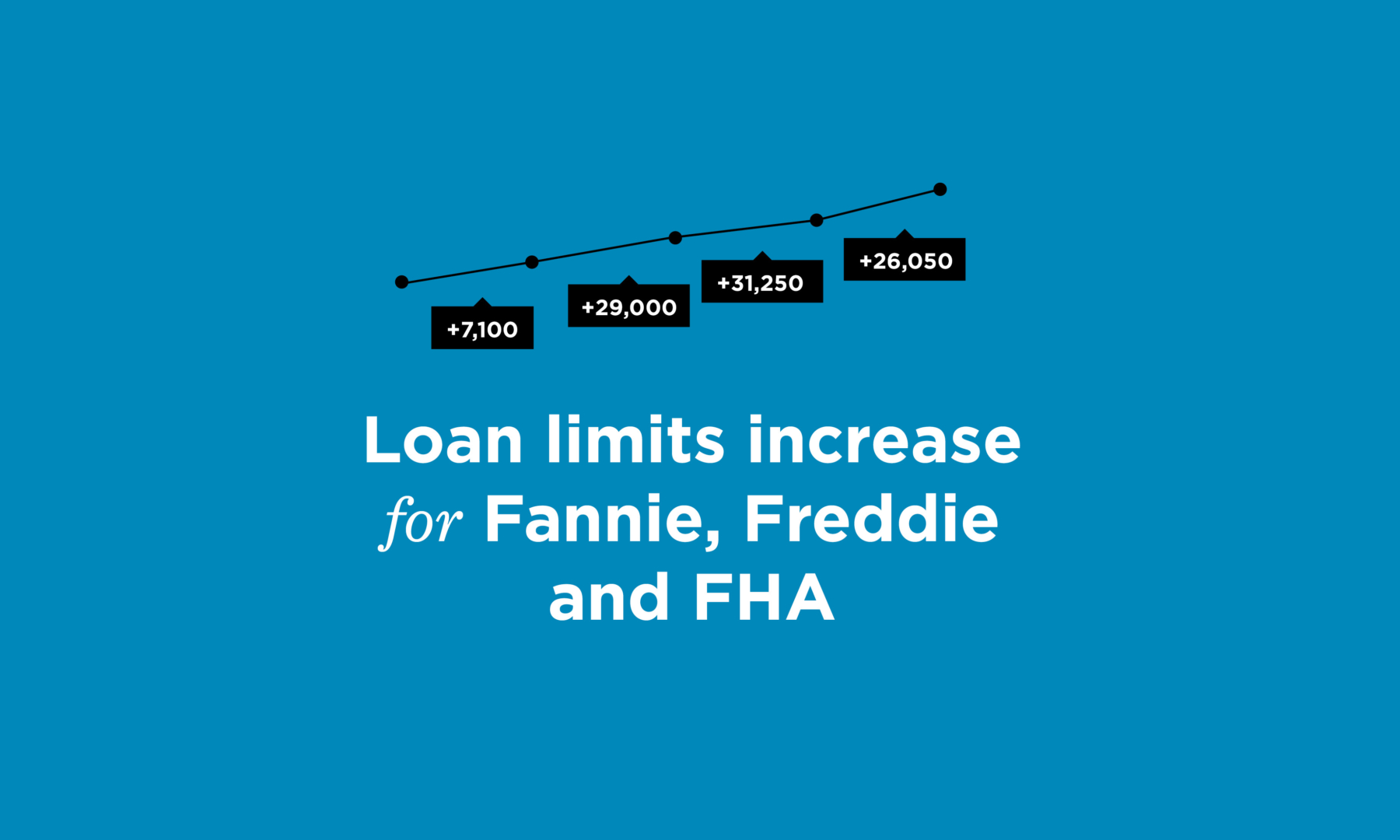

What else is new? Loan limits increase for Fannie, Freddie and FHA, The loan limits apply to all conventional loans delivered to fannie mae for whole. The federal housing finance agency (fhfa) establishes fannie mae's loan limits for 2024, defining the maximum conventional loans that fannie mae can acquire.

The Loan Limits Apply To All Conventional Loans Delivered To Fannie Mae For Whole.

Limits vary based on location and property size.

1 Bureau Of Labor Statistics, Fannie Mae Analysis.

Conforming loan limits, at their core, are used to separate conventional loans from jumbo loans.

Posted in 2025